Don’t Send Your Profits Away

Invest Them in

American Steel.

The 2025 Section 179 limit has doubled to $2.5 Million. Purchase and place Cincinnati Incorporated machinery in service by December 31st to write off 100% of the cost.

The Rules Have Changed. Your Strategy Should Too.

New tax legislation for 2025 has significantly expanded the Section 179 deduction limits. This is the most aggressive capital equipment incentive we’ve seen in years.

Deduction Limit

$2,500,000

Previously $1.25M

Bonus Depreciation

100%

Available for amounts over the limit.

Spending Cap

$4,000,000

This is the max spent before the deduction phases out.

Ready to Ship. Ready to Deduct.

For Section 179, equipment must be "placed in service" by Dec 31. Place your order by December 10th to qualify.

Why Spend Your Deduction on CI?

-

Direct Factory Support

Factory-direct service and support means less downtime, direct access to experts, and more profit for your shop.

-

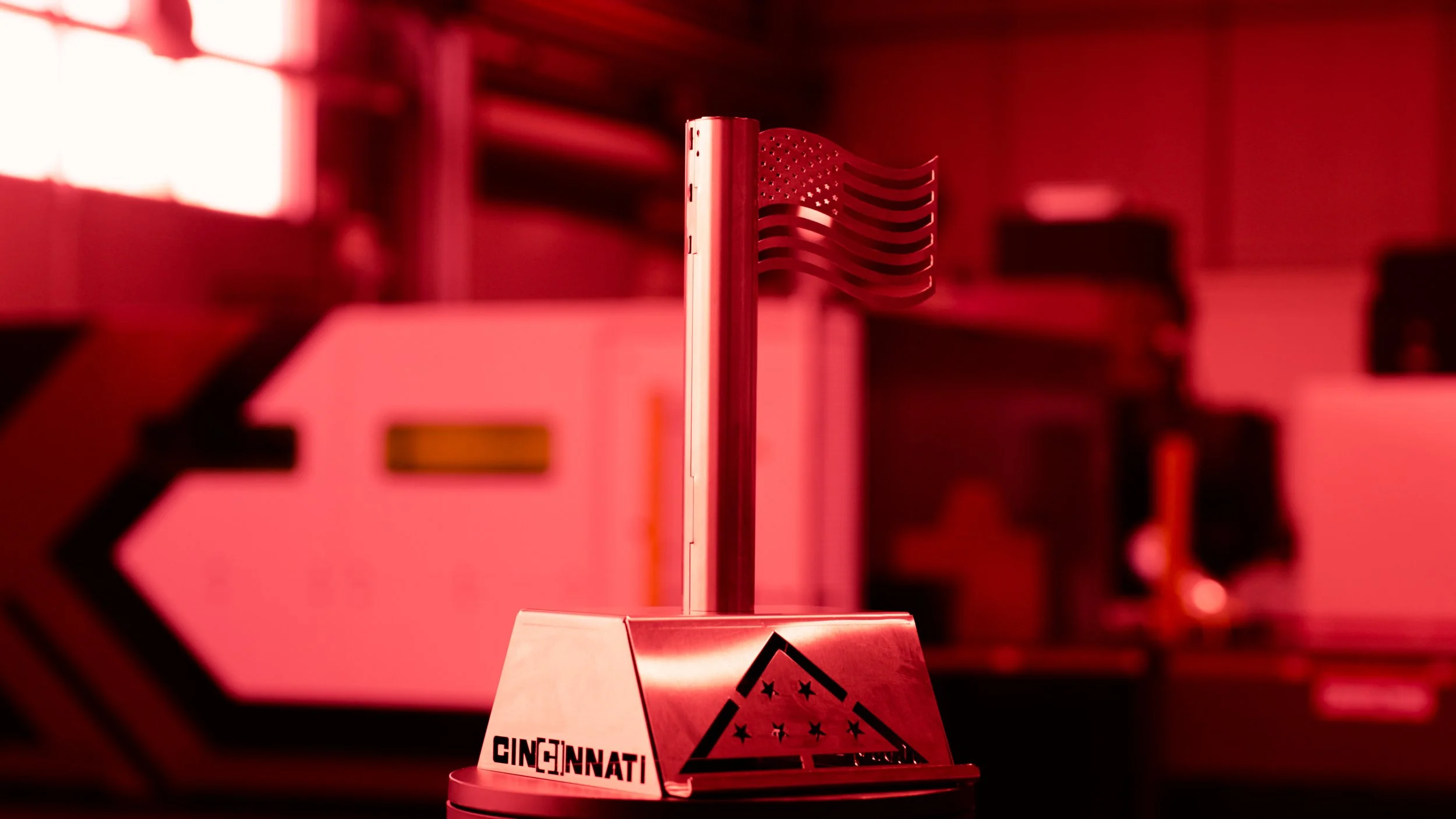

Built in the USA

Rugged durability and unmatched precision, built by American workers in Harrison, Ohio since 1898.

-

Longevity & Resale Value

You're not just buying a tax break; you're buying a legacy asset. CI machines are built to last and hold their value.

Secure Your Machine Before the Deadline.

Inventory is limited. Contact us today to lock in your shipment for 2025 delivery.